Rethinking rentals

Edinboro needs affordable single family housing.

And short-term rentals.

And long-term rentals.

AND student RENTALS.

Edinboro needs a healthy mix of all of these things. But right now, there are a few too many student rentals, which means some properties may be vacant or under-performing and maybe they have been for too long. This is due to a host of reasons, things like a general decline in the student population, more and more students attending school virtually from their hometowns, and more students living on campus for a little longer than they did in years past. Whatever the reason, there’s a shift happening that’s impacting the bottom-line of rental property owners and the overall housing market in Edinboro.

Overview

We’ve spent the past year or so learning about Edinboro, surveying the public, engaging stakeholders, and getting a better feel for its place in the region. Among the many things we’ve learned, we’ve come to know that 1) Edinboro needs housing that’s affordable enough to leave folks a little extra spending money each month AND 2) that Edinboro is in a great position to be a year-round getaway destination or the next best place to live! These two things might not seem connected right away, but actually they’re super connected by one thing: the housing market.

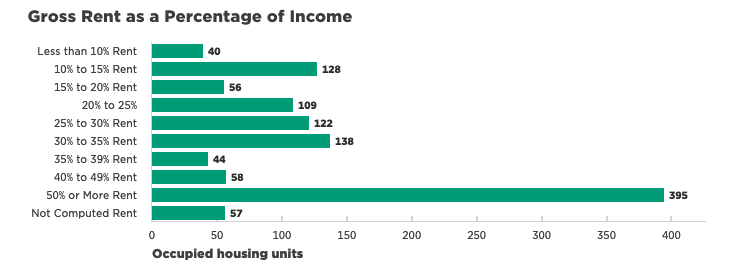

It’s a general “affordability rule” that people shouldn’t spend more than 30% of their income on housing related expenses, yet nearly 40% of all renters and owners in Edinboro are spending more than that and are considered cost-burdened by housing-related expenses. Worse still, almost 20% of these folks are spending more than 50% of their income on these living costs. All of this means that there are plenty of people already living in Edinboro who would benefit from more affordable options. It also means that if folks are spending a little less to keep a roof over their heads, they have more money to spend in local shops and restaurants, giving the overall economy a boost.

Great places to live and great places to visit offer a lot of the same things. They offer recreation opportunities, places to shop and be sociable. They are places where people are proud and welcoming and make you feel at home. And they offer a variety of places to stay, forever or for the night. As Edinboro secures its position as a place for All Seasons, there’s an increased opportunity to create more ways for people to stay!

Accommodation is a vital and fundamental part of the tourism supply chain and it’s a broad category! We’re talking campgrounds, RV parks, cabins, hotels, motels, yurts, treehouses (yep!) – the assortment is diverse and wide and appeals to tastes and budgets across the spectrum. One of the fastest growing sectors in the industry is the short-term lodging market. Think Airbnb and VRBO – self-contained, fully-furnished apartments or houses available for rent on a short-term basis, usually by the night and even for a month at a time. There are several folks in Edinboro who are actively engaged in this cottage-industry!

Here’s how the dots connect. The need for affordable single family homes and the opportunity for a few more short-term rentals in Edinboro can both be served by the aforementioned inadequately large stock of student rentals. There is an opportunity for landlords and property owners to reimagine the student rental properties that once served them (and the community) well as resources for a shifting market. Some of these properties might continue to successfully serve the student population, but for under-performing properties, it might be time to rethink their use. Consider converting these properties into affordable single-family homes for sale or for rent, OR explore the income potential of converting to a short-term lodging rental.

Spreading the word about this opportunity is a critical first step. And since revenue streams are on the line, getting property owners engaged will likely require more than a letter or a few social media posts. It is recommended that the Borough create an educational/awareness opportunity for rental property owners to get updated on the current market, introduced to plans that could impact their investments, and connected with resources to facilitate any transitions they might pursue. Once this event is on the books, those letters and social media posts will be extra-handy!

Access to Capital

We know that there’s plenty of money out there to get projects started (and finished), but that doesn’t mean it’s easy to come by OR that we can afford it! There are finance tools that organizations can create to help make money more accessible for projects that address housing needs and make an impact in the community. We recommend the development of a Revolving Loan Fund that would provide low-interest loans or grants to property owners who would buy and convert rental properties OR convert owned rental properties back to single family owner occupied homes. Because restrictions associated with common federal funding sources often compromise these accessibility goals, it is recommended that Edinboro pursue the development of a locally capitalized fund to afford greater flexibility in lending.

A Revolving Loan Fund (RLF) is a replenishing source of capital or funding from which loans are made. While never intended to replace more traditional lending sources like community banks, it can serve as an invaluable resource for outcome-related development projects like affordable housing. RLFs are intended to be self-sustaining, evergreen sources of capital for communities, meaning they are maintained by the repayment of principal and grow through interest payments. Generally, there’s a lot of flexibility afforded to entities managing these funds, so the RLF can be tailored to meet Edinboro’s specific needs. Because RLF’s are a common and valuable tool in the economic development toolbox, supporting guides and technical assistance resources are widely available.

Action Steps – Introduce Market Opportunities to Property Owners

Who

Borough of Edinboro + Realtors, Local Airbnb Owners, Chamber, Local Lenders

How

Plan and host a workshop for rental property owners – a Rental Reuse Workshop Guide has been developed for your use

When

Q3

Action Steps – Revolving Loan Fund

Who

ECED with support from the Borough of Edinboro and PA DCED

How

Include accountants, lawyers, bankers, alternative lenders, educators, local business owners

When

Q3

Who

RLF Committee and ECED with support from the Borough of Edinboro and PA DCED

How

Define who the program will serve, the type of financing it will provide, size and term of loans, etc.

Remember, this will impact your sources for seed capital!

When

Q3

Who

RLF Committee and ECED with support from the Borough of Edinboro and PA DCED

How

Funding acquired for capitalization is usually the equivalent of a grant – it does not need to be paid back. Exclusively local sources allow for the most flexibility but many federal resources can be utilized, as well.

When

Q3 – Q1 2022

Who

RLF Committee and ECED with support from the Borough of Edinboro and PA DCED

How

Borrower eligibility, eligible use of funds, loan amounts / equity requirements, underwriting policies, default + delinquency terms, etc.

This will be determined by program funding sources!

Learn more here.

When

Q3 – Q4

Who

RLF Committee and ECED with support from the local lending community

How

Share your proposed program outline with local finance partners to make sure it fills a gap in the lending market

When

Q4

Who

RLF Committee and ECED with support from the local lending community

How

Plan should address (in detail) all administrative requirements (fiscal agents, staff capacity, marketing materials, loan process, etc), including the creation of the Loan Review Committee.

Loan review committees are often made up of one or two RLF committee members PLUS a few other folks from the community, including an elected official, representative(s) of minority populations, and an economic development professional.

When

Q4 – Q1 2022

Who

RLF Committee, ECED, and Loan Review Committee with support from the local lending community

How

Program criteria and operating plan approved by Loan Review Committee; Staffing in place; program launch

When

Q1 – Q2 2022

Note: If the RLF is developed under the umbrella of an existing entity, all established protocols for committee formation, resolution adoption, hiring, etc. should be followed.

Funding Resources

CDBG – Borough could allocate resources to this fund annually for a set number of years (to be re-evaluated every two years to assess program impact/need)

A grant or loan could be awarded to developers (or property owners) to convert rentals to single family homes with the following caveats (confirm with CDBG administrator):

- The entire dwelling would have to be fully renovated to meet HUD’s Housing Quality Standards and current City Building Code.

- The eventual owner/occupant would have to be at, or below, 80% of the Area Median Income (Edinboro’s AMI is $71,500, so 80% would be $57,200), and would have to remain the owner/occupant for five years.

- The sale price of the newly renovated single family home would have to be less than 95% of the FHA determined median home value for the HUD determined Metropolitan Area: $131,290

The Erie County Renaissance Block Program is a financial incentive-based program designed to address and reverse housing blight in Erie County. The Borough could use these funds (up to $100,000 per application) to further capitalize a program seeded by CDBG dollars OR to launch a separate program aimed at blight prevention and/or remediation, based on community need.

Amount: Up to $100,000

Applications open: annually, and close March 31, 2021

Click here to learn more.